China's military firms struggle as corruption purge bites

China’s major military companies suffered a sharp decline in revenues last year as an extensive corruption purge disrupted weapons procurement, according to new research released Monday by the Stockholm International Peace Research Institute (SIPRI).

The findings stand in stark contrast to booming global defence sales, driven by the wars in Ukraine and Gaza, rising geopolitical tensions, and accelerated military spending by Western and Asian governments. SIPRI reported that revenues among the world’s top 100 arms manufacturers rose 5.9% to a record $679 billion.

SIPRI’s military expenditure programme director, Nan Tian, said widespread graft allegations within China’s arms procurement system resulted in “major contracts being postponed or cancelled throughout 2024,” slowing Beijing’s long-term modernisation plans and raising questions about when delayed capabilities will come online.

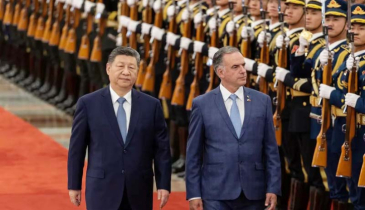

China’s defence establishment has been a central target of President Xi Jinping’s sweeping anti-corruption drive since 2012. The campaign reached a new peak last year when the powerful People’s Liberation Army Rocket Force—one of China’s most strategically sensitive units—was hit by a purge.

In October, eight senior generals were expelled from the Communist Party on corruption charges, including He Weidong, the PLA’s second-highest-ranked officer and a member of the Central Military Commission, Xi’s top military advisory body.

Diplomats in the region say Beijing has not disclosed the full scale of the purge, leaving uncertainty over how deeply it cuts into the military hierarchy and how it may affect command-and-control stability at a time of heightened regional tensions.

Chinese Arms Revenues Drop 10%

SIPRI found that revenues of China’s leading defence firms fell 10% in 2024, making Asia–Oceania the only region in the world to record a decline. Meanwhile, Japan’s defence companies saw revenues jump 40%, Germany 36% and the United States nearly 4%.

The revenue slump comes despite China’s continuously rising defence budget, now the world’s second largest, and decades-long investments aimed at surpassing US military dominance in Asia. China has already built the world’s largest navy and coast guard fleets, developed advanced hypersonic missiles, expanded its nuclear arsenal and deployed increasingly sophisticated air and sea drones.

Yet these advancements have not insulated the industry from the shockwaves caused by stalled procurement.

SIPRI reported revenue drops across China’s three biggest state-owned defence contractors:

- AVIC (Aviation Industry Corporation of China), the country’s largest arms manufacturer

- Norinco, the main producer of armoured vehicles and land systems

- CASC, the aerospace and missile conglomerate

Norinco suffered the worst decline, with its revenue falling 31% to $14 billion.

Analysts say the pullback reflects both internal disruption and growing caution among procurement officials wary of being caught up in ongoing investigations.

Despite the downturn, experts expect China’s defence expansion to continue in the long run, though the pace of modernisation—especially the rollout of new naval, hypersonic and missile capabilities—may be slower and less predictable as Beijing attempts to reassert control and rebuild trust across its sprawling military-industrial complex.

.png)